Competition heats up for rail freight business on Class 1's and Texas is at the epicenter

June 28, 2023 - TRA Newswire -

In less than 90 days, all of the Class 1 railroads that operate in Texas have gone on the offensive to either create new business or see how they can funnel existing freight business from their competitors.

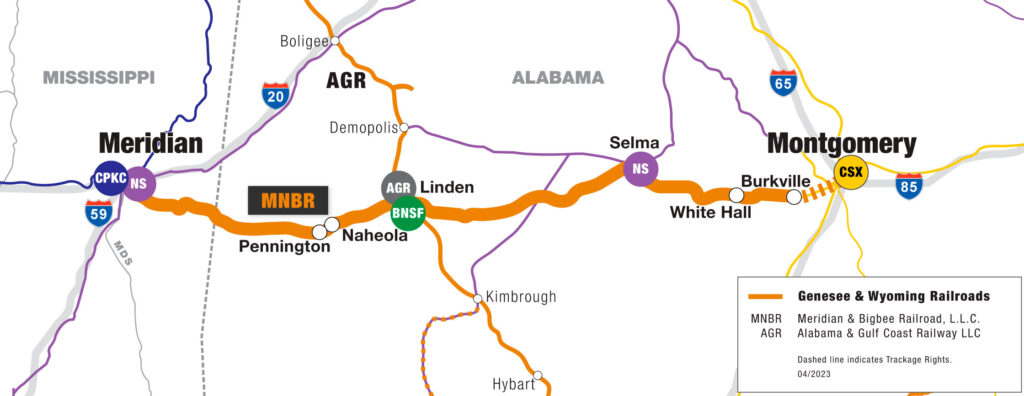

The latest competitive shot was fired today when CPKC (newly merged Canadian Pacific/Kansas City Southern) announced a deal with Eastern powerhouse CSX Railroad to cobble together a little used connection between the two railroads that is operated by short line company Genesee and Wyoming in the Southeast U.S.

All of the railroad partnership and expansion deals announced since April 14, when the CPKC merger became official, will put Texas at the epicenter of what could be a significant increase in the amount of freight traffic in the future.

"The competitive frenzy underway between CPKC, BNSF and Union Pacific and others will result in positive growth across the Lone Star network," according to Texas Rail Advocates President Peter LeCody. "The CPKC merger kind of woke up the other sleeping giants that seemed to have been content with business the way it was. Railroads had been losing market share to the trucking industry and the CPKC North American railroad linkage may have been a needed wake-up call. We're bound to see more tonnage originate, terminate or traverse through Texas as the railroads go out for business," said LeCody.

The newly announced CSX-CPKC arrangement with use a track operated by a subsidiary of Genesee & Wyoming that runs from Meridian, Mississippi to Myrtlewood, Alabama. At present only local traffic is served and the track is only rated for speeds up to 25 miles per hour. Some sections are only rated at 10mph.

The newly announced CSX-CPKC arrangement with use a track operated by a subsidiary of Genesee & Wyoming that runs from Meridian, Mississippi to Myrtlewood, Alabama. At present only local traffic is served and the track is only rated for speeds up to 25 miles per hour. Some sections are only rated at 10mph.

CPKC CEO Keith Creel indicated that the two railroads will upgrade the rail line so it can carry more traffic and provide a new routing between the Southeast and Mexico, taking trains through Texas. According to Joe Hinrichs, CEO of CSX, the arrangement “provides shippers with a compelling transportation option with access to markets in Texas and Mexico as well as into the heart of the thriving and dynamic U.S. Southeast.”

The connection at Meridian, MS. would funnel trains directly into the DFW market on what is called the "Meridian Speedway". The 320-mile long speedway was upgraded over a decade ago from Meridian to Shreveport, Louisiana in a joint venture by Norfolk Southern (NS) and Kansas City Southern.

If regulators approve the deal, CPKC will acquire some 50 miles of track from Myrtlewood to Meridian and CSX would assume control of the current lease of the Meridian & Bigbee Railroad eastward to Montrogomery, Alabama. Genesee and Wyoming would still serve local customers but would receive CPKC properties in Alberta, Canada in return.

Looking back over the past 90 days, here's how the competition started to heat up:

> April 14, 2023 marked the start of a new partnership between Canadian Pacific (CP) and Kansas City Southern (KCS), now known as CPKC throughout Texas and the rest of North America. The merger of the two Class 1 railroads followed a thirty day comment period after the Surface Transportation Board issued their final decision on March 15. The blending of the two railroads creates the first North American railroad in history to serve Canada, the United States and Mexico.

>April 24, 2023 marked when Union Pacific, Canadian National and Grupo Mexico Transportes (GMXT) formed an alliance to compete for cross-border rail traffic. The creation of Falcon Premium intermodal service offers a Mexico-US-Canada seamless rail connection through Chicago

>.May 16, 2023 Union Pacific announced faster, direct intermodal service from Texas to other key markets. and will provide a direct, quicker intermodal service from Port Houston Barbours Cut container terminal to cities north and west of Texas.

> June 2, 2023 BNSF Railway initiated regular intermodal service between the Port of Houston and both its massive Alliance facility, north of Fort Worth, and onward to Denver. The twice a week service from Port of Houston to Fort Worth and weekly service to Denver follows a year of testing market demand in the busy Gulf Coast corridor.