Tony Hatch at the Southwestern Rail Conference: There's a fight for the soul of the North American freight rail industry

April 23, 2023 - TRA Newswire -

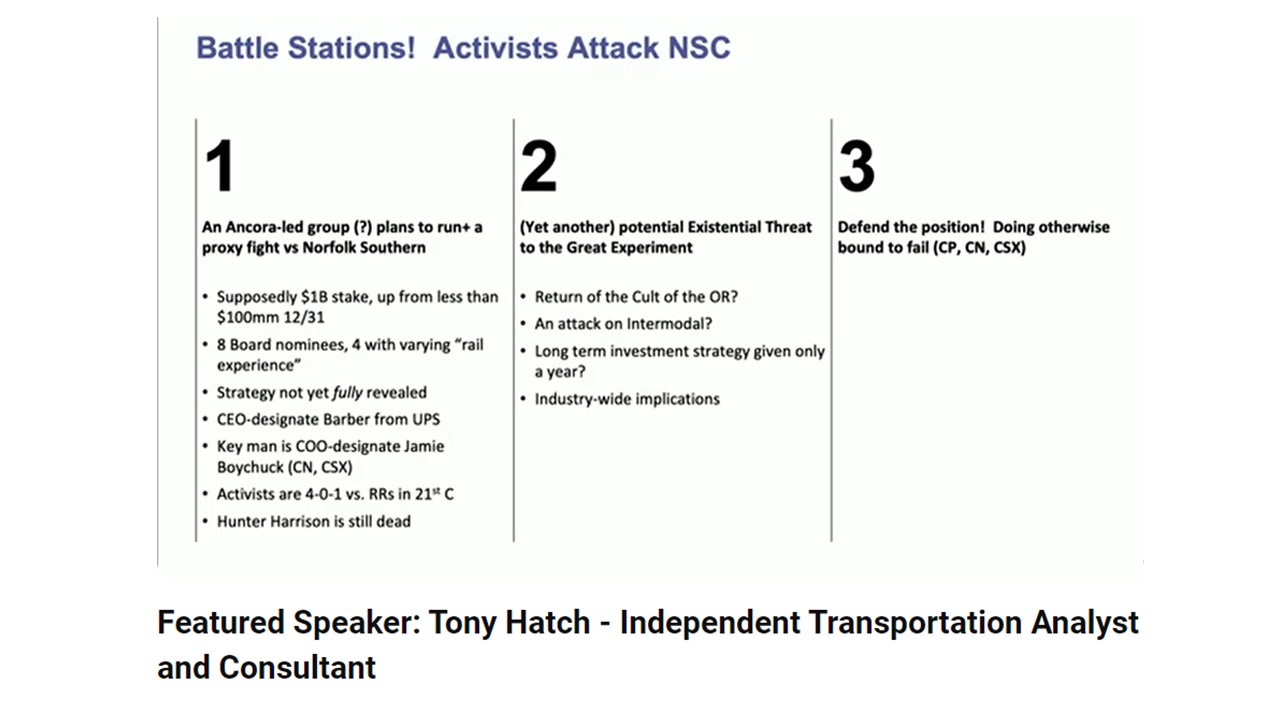

Independent freight rail analyst Tony Hatch, at the Southwestern Rail Conference, said that freight railroads face daunting challenges from hedge funds that see Class 1's in excellent financial condition, the best shape they have been since 2016-2017, and are are aiming to change their board of directors with fresh blood.

Activist investors have desended on the larger freight railroads in recent years with some success. Norfolk Southern Railroad is now in a fight for it's life, according to Hatch and at the annual meeting on May 9th there is a chance that Ancora, a hedge fund, may attempt to put seven new people on the NS board. "It will have raminfications for railroads eveywhere,"according to Hatch."For the long term health of the industry they need to be stopped."

Hear Tony Hatch's complete presentation here: https://www.youtube.com/watch?v=e0GqolIu9Hc

In his presentation, Hatch said that Union Pacific has the best franchise in the railroad business but never quite lives up to its full potential and that's why Jim Vena was brought in to stimulate the company.

Self-funding your infrastructure is a distinct advantage for railroads but the industry faces competition from government funded autonomous truck fleet programs, according to Hatch, and that could result in loss of business.

The industry analyst said that the Canadian Pacific Kansas City Southern (CPKC) merger will be the last major merger of his lifetime. Competition from the CPKC alignment has already increased competition among other railroads and that should spur growth, which has been lagging. Hatch pointed out that intermodal service peaked in 2018 and railroads need to change their narrative through growth.

On the East Palestine incident last year, Hatch laid some of the outcome on government policy which compels railroads to carry hazardous materials, under their common carrier responsibility. Ralroads must make a reasonable effort to carry hazmat goods, have an overall very good safety record and the resulting finger pointing about the accident was an over-reaction. Activist investors saw a "slower antelope in the herd and like a hyena that's the one (Norfolk Southern) they attacked."

On the East Palestine incident last year, Hatch laid some of the outcome on government policy which compels railroads to carry hazardous materials, under their common carrier responsibility. Ralroads must make a reasonable effort to carry hazmat goods, have an overall very good safety record and the resulting finger pointing about the accident was an over-reaction. Activist investors saw a "slower antelope in the herd and like a hyena that's the one (Norfolk Southern) they attacked."